Insurance tech is having its moment. Startups in the space received $33b of funding in 2019, the largest amount in the industry’s short history. As we head into the last quarter of 2020, we’re seeking to better understand where insurtech startups are filling traditional insurance market gaps.

Insurance products compete on two axes: customer experience and underwriting accuracy. Over the past half-decade, insurtech startups have used machine learning and data collection capabilities to hit on both of these axes, catering to digital, transparent, on-demand consumer preferences. Customers can now manage the entire insurance experience online — from policy shopping to claims settlement — with lower premiums than traditional insurers.

The full Radar can be found here.

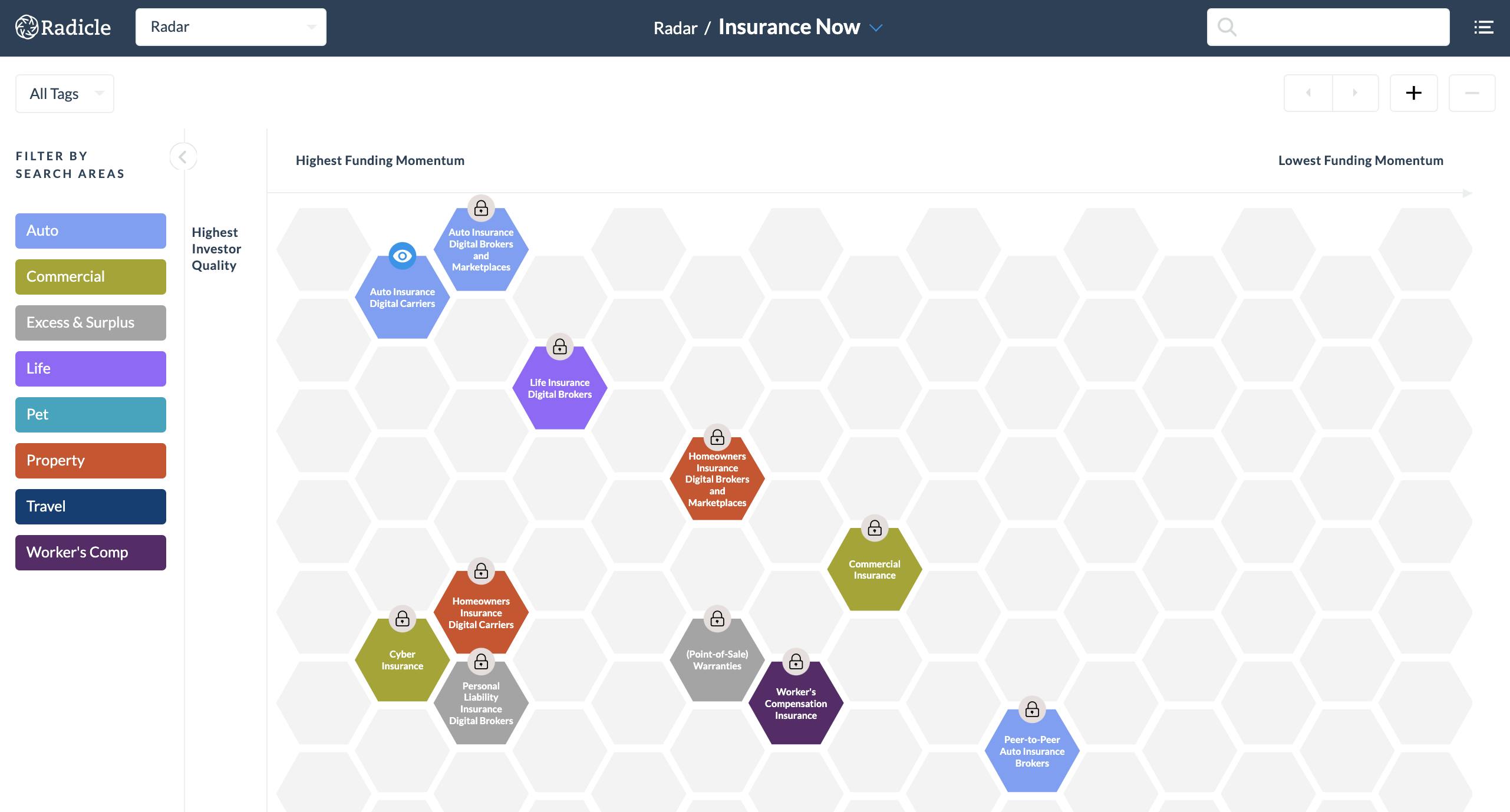

To dig into the startups in this area, we turned to our Radar product, a market map on steroids that adds context to sectors and helps identify startups filling market gaps. In this Radar, we identified 20 sectors filling 3 primary market gaps: a product experience gap, an insurance product gap, and an underwriting gap. This piece briefly walks through each gap with example startups in each category.

Product Experience Gap

The product experience gap fills in a key hole where legacy insurers have traditionally failed: customer experience. New-age, digital solutions are providing transparent policies, immediate claim fulfillment, and active customer support. Solutions addressing this gap sit across the entire spectrum of insurance products. Example sectors include Auto Insurance Digital Carriers (Clearcover), Travel Insurance Providers (Pluto), and Homeowners Insurance Digital Carriers (Hippo).

Take Clearcover as an example. Clearcover offers simple, online-only auto insurance with an improved customer experience. Through the company's app, policyholders can instantly file claims (which are paid within a few days), manage bill payments, and provide proof of insurance without the need for a wifi connection or cell service. Additionally, Clearcover's policies include "alternate transport coverage," a more flexible repair stipend compared to traditional insurer's rental car coverage. With alternate transport coverage, Clearcover customers can spend their stipend on public transportation, rental car coverage, and ridesharing services like Uber and Lyft.

Or consider Pluto, a travel insurance provider. Pluto addresses the opaque and bureaucratic qualities of the travel insurance industry by making policies easy to understand. Through Pluto's smartphone app, customers can evaluate and purchase jargon-free coverage options, receive access to medical assistance, and submit claims for events like flight delays in 10 minutes or less.

Insurance Product Gap

The insurance product gap addresses cohorts that previously had little or no coverage. This encompasses solutions like Short-Term Rental Property Insurance Carriers (Slice), Ridesharing Insurance (Buckle), and Drone Insurance Digital Brokers (Thimble).

One start-up addressing the insurance product gap is Slice (Short-Term Rental Property Insurance Carriers), a home insurance provider for rental hosts. Since standard homeowner’s insurance policies don’t cover Airbnb rentals, home-share hosts are vulnerable to denied claims or even canceled coverage if their insurer discovers that their home doubles as a business. Slice helps solve this problem by supplementing a host’s existing homeowner’s policy and eliminating the possibility of losses being reported to the host’s insurer. What’s more, Slice is unique in that its insurance offering is completely on-demand: coverage is billed by the night, and hosts only pay for the exact amount of coverage they need.

Other startups like Buckle focus on underserved segments of the auto market. Buckle provides rideshare drivers with one policy to cover their personal driving and rideshare driving. Instead of supplementing an existing auto policy, Buckle replaces a driver’s current auto insurance and provides continuous 24x7 coverage at one low rate. While traditional insurance companies evaluate factors like age and driving history, Buckle takes other driving elements into account, such as rideshare star rating. Buckle launched its core rideshare insurance policy in 2019 and announced a partnership with Lyft earlier this year.

Underwriting Gap

The underwriting gap addresses high consumer policy cost through providing more accurate, personalized underwriting. This encompasses solutions like Auto Insurance Digital Carriers (Metromile, Root) and Short-Term Rental Property Insurance Carriers (Slice).

Startups like Metromile provide coverage based on miles driven, tracking mileage using an in-car dongle that pairs to a smartphone app, while Root considers over 200 driving behavior variables such as braking, driving time of day, miles driven, and more. By using telematics data to improve coverage accuracy, these companies offer an improved insurance product for consumers, saving them money relative to legacy carriers. Root weighs driver behavior significantly more than traditional insurers: behavior has a 35% influence on rates, compared to just 3% for traditional carriers.

– – –

The rise of insurtech over the last 10 years demonstrates insurers’ focus on tech across new areas including on-demand and usage-based insurance. As partners to incumbents and independently licensed insurers, insurtech startups utilize tech to reimagine and improve stale insurance products.

If you have any questions on the piece or curious about hearing more, contact joe@radicleinsights.com